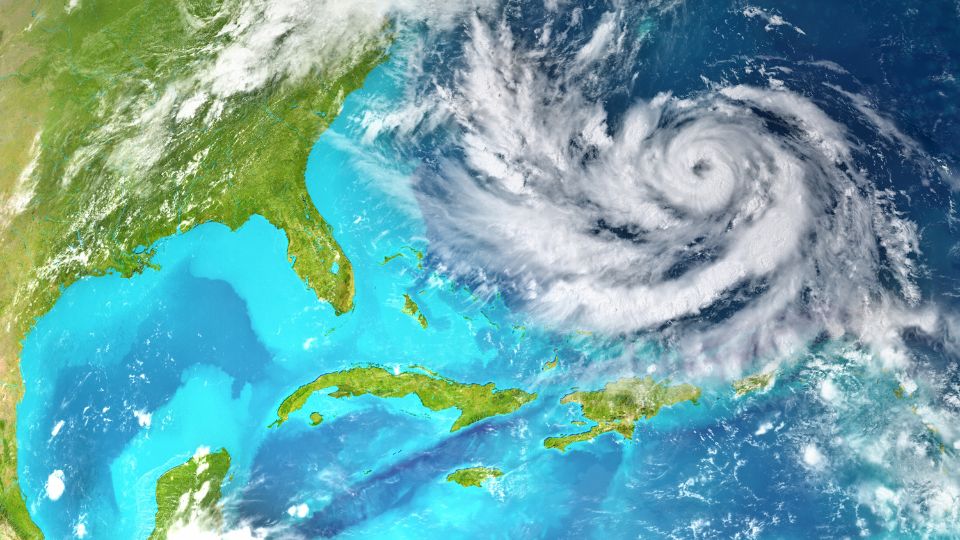

Going solar is one of the smartest financial decisions a South Florida homeowner can make. However, navigating the landscape of tax credits and incentives can be confusing. Here is exactly how you can reduce the cost of your solar installation this year.

The 30% Federal Solar Investment Tax Credit (ITC)

The most significant incentive available right now is the Federal ITC. This allows you to deduct 30% of the total cost of your solar system from your federal income taxes.

- What it covers: Solar panels, labor, permitting, and even battery storage systems.

- No cap: There is no maximum amount that can be claimed.

- Rollover: If you don’t have enough tax liability to use the full credit in one year, you can roll it over to the next.

Florida Property Tax Exclusion

Many homeowners worry that adding a premium solar system will increase their property taxes. In Florida, that is not the case. Thanks to the Property Tax Abatement for Renewable Energy Property, 100% of the added value from your solar system is exempt from property taxes. You get the increase in home value without the tax hike.

Florida Sales Tax Exemption

Unlike buying a car or furniture, your solar energy system is 100% exempt from Florida’s 6% sales tax. On a standard residential installation, this saves you hundreds, if not thousands, of dollars immediately upfront.

Why Act Now?

While the Federal ITC is locked in at 30% for now, local utility rates in Miami and Fort Lauderdale continue to rise. Locking in your solar investment today protects you from future rate hikes.

Ready to see how much you can save? Contact us today for a free solar analysis and let’s calculate your potential tax credit.